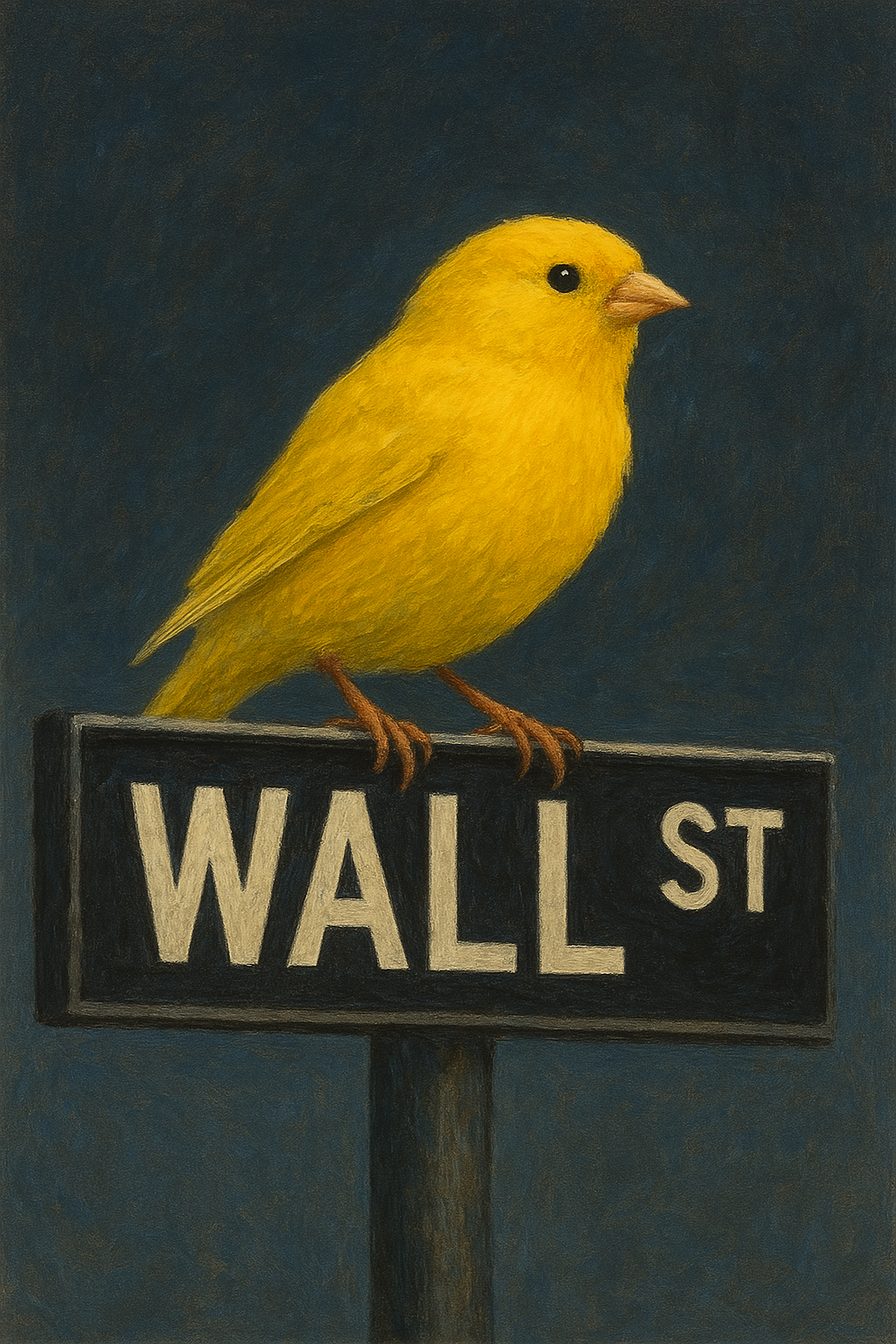

Wall St. Canary

A clear focus on news impacting your investments.

Over 50% of financial news and media reporting focuses on the 20 largest stocks.

What if you invest in companies outside of that group?

What if you miss a story that impacts one of your holdings?

Enter Wall Street Canary. A simple weekly report, delivered via e-mail that highlights key news and numbers that impact your specific holdings.

Learn more, and sign up at wallstcanary.com

For example, here’s the report I got last week:

Wall Street Canary

Your Early Warning System for Market Intelligence

During the past week—especially over the last three days—several developments matter for your holdings (XOM, LLY, HD, JNJ, UNH, ABBV, CFLT, CAT):

Eli Lilly: Management said it expects U.S. approval of its oral obesity drug orforglipron within 1–2 months and indicated it has supply ready for launches across multiple countries; separately, Lilly and Nvidia announced a $1 billion joint AI research lab to accelerate drug discovery. Both support Lilly’s pipeline durability and obesity franchise optionality, but they also heighten expectations into near-term FDA decisions. (reuters.com)

UnitedHealth: A Senate committee report (as described by Reuters, citing the Wall Street Journal) criticized coding tactics used to boost Medicare Advantage payments; shares slipped on the headline. Regulatory scrutiny can pressure managed-care multiples and heighten policy risk into the spring rate-setting cycle. (reuters.com)

Pharmaceuticals pricing policy: Johnson & Johnson and AbbVie each reached deals with the U.S. administration to lower certain drug prices (with tariff relief/exemptions as part of the agreements). While specifics are still emerging, these arrangements underscore persistent U.S. pricing risk for large-cap pharma and could trim long-term margin assumptions for diversified drug franchises. (reuters.com)

Exxon Mobil: The company guided that lower crude prices will weigh on Q4 upstream earnings; refining margins may partly offset, with full results due January 30. Expect earnings volatility tied to commodity moves; the dividend and balance sheet remain the core of the equity story. (reuters.com)

Investment implications for your portfolio:

Healthcare dominance in your lineup (LLY, JNJ, UNH, ABBV) is facing simultaneous but mixed catalysts—policy/pricing overhang for JNJ/ABBV and managed-care scrutiny for UNH, against meaningful innovation momentum at LLY. Net effect: elevated dispersion in outcomes within the sector; stock selection matters more than sector beta here. (reuters.com)

Energy sensitivity remains intact for XOM into its January 30 print; short-term cash flow is tethered to crude/gas realizations even as downstream could cushion results. (reuters.com)

Actionable suggestions (based on this week’s developments):

Rebalance healthcare exposure toward a lower single-sector weight, targeting <30% of equities, given concurrent U.S. pricing actions (JNJ, ABBV) and MA scrutiny (UNH), while maintaining core LLY exposure for innovation-led growth. Consider redeploying any trim proceeds into underrepresented cyclicals (e.g., CAT) or a broad-market ETF to restore balance. (reuters.com)

Defer adding to XOM until after January 30 results to reduce event risk; reassess position sizing once the earnings mix (upstream vs. refining/chemicals) is clearer. (reuters.com)

For LLY, avoid chasing potential pre-approval momentum on orforglipron; instead, plan to rebalance on strength post-FDA decision, letting the launch/pricing details settle before sizing up. (reuters.com)

Portfolio risk note:

Sector concentration: 50% of your stocks are in healthcare (LLY, JNJ, UNH, ABBV), exceeding the 30% threshold—this amplifies exposure to U.S. policy and reimbursement headlines. Address via measured rebalancing rather than wholesale shifts.

Country concentration outside the U.S.: No trigger under the 40% non-U.S. threshold.

Futures and options are considered too risky for use without a professional.

This report is for informational and entertainment purposes only and does not constitute financial advice—always consult a qualified financial advisor before making investment decisions. Wall Street Canary does not guarantee the accuracy, completeness, timeliness, or reliability of any information provided. By using this service, you agree to our Terms of Service.

During Wall Street Canary's testing period, write info@wallstcanary.com to unsubscribe.

© 2025 Wall Street Canary. All rights reserved.